Branch Office Registration of a Foreign Company in Nepal

7 April 2019

The Registration of branch office of a foreign company in Nepal is governed by the Companies Act 2006 (2063) (“Companies Act”) . The Office of Company Registrar (“OCR”) is the competent authority to register the branch office.

This article covers the registration process of branch office of foreign company in Nepal.

1. What are the procedure to register the branch office?

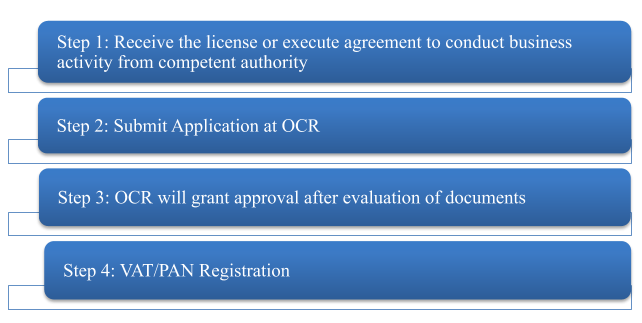

Following procedure is required to register the branch office in Nepal.

2. What is the cost (government fee) required for registration of branch office?

The government fee for the registration of branch is based on proposed investment amount to be made in Nepal. The applicable government fee for branch registration is as follows:

| Amount of proposed investment (Amount in NPR) | Registration fee (Amount in NPR) |

| Up to 10,000,000 | 15,000 |

| From 10,000,001 to 100,000,000 | 40,000 |

| From 100,000,001 to 200,000,000 | 70,000 |

| From 200,000,001 to 300,000,000 | 100,000 |

| From 300,000,001 to 400,000,000 | 130,000 |

| From 400,000,001 to 500,000,000 | 160,000 |

| Above 500,000,000 | 3,000 plus for each additional 10,000,000 |

If the amount of proposed investment is not fixed:

A lump sum fee is prescribed for the foreign company in case the proposed investment is not fixed. In that case, the applicable government fee is NPR 100,000.

3. What is the timeline for the registration of branch office?

Generally, it will take 2 to 3 weeks for the completion of registration.

4. What are the business activities permissible for branch office?

Branch Office can operate business activities which are permissible in Nepal. However, the business or transaction to be carried out by the branch office must be similar to that of the business and transaction of the foreign company carries out in its country of incorporation.

5. What sorts of approval is required for branch office registration in Nepal?

5.1 Section 154 (2) of the Companies Act requires approval from the competent government authority to set up a branch office in Nepal.

5.2 As a matter of practice, branch office are registered based on license, selection or agreement with the competent authority. If a foreign company is selected by, or enters into an agreement with the competent authority, such selection or agreement is also considered to be the approval for the purposes of branch office registration. Registration can be done on the basis of such selection or agreement.

6. Is there is any minimum amount of Investment for the branch office registration?

The Companies Act does not specify minimum amount of investment that a foreign company is required to put in the registration and operation of its branch office. Amount should be invested based on the need of company for the operation of its business.

7. What would be the legal status of branch office in Nepal?

7.1 Investment to be made to run the branch office is not considered as foreign investment, therefore does not require any foreign investment approval. Foreign investment approval is only required if the foreign investor who want to conduct the business by establishing the local subsidiary company in Nepal.

7.2 Registering the branch office doesn’t gives the legal status of registering the separate legal person. It is just a registration of branch office of foreign company within the territory of Nepal.

8. What are the other compliance requirement for branch office ?

8.1 The branch office once registered is not subject to any periodic renewal requirement.

8.2 Branch office are required to be registered at the Inland Revenue Department for tax purposes will require to pay income tax in Nepal.

8.3 The branch office is required to appoint the auditor and prepare the annual financial statement and such statement needs to be submitted to the Office of the Company Registrar annually.

9. Related Article

For article related to “Company Registration in Nepal ” please go through the link mentioned below:

Link: Company Registration in Nepal

Disclaimer: This article is for informational purposes only and shall not be construed as legal advice, advertisement, personal communication, solicitation or inducement of any sort from the firm or any of its members. The firm shall not be liable for consequences arising out of any action undertaken by any person relying on the information provided herein.