Social Security Fund (SSF) Registration in Nepal

The issue related to Social Security Fund (SSF) is governed by Social Security Act, 2018 (2075). The Act requires every company/employer to enlist their name and its employees in the Social Security Fund. This questionnaire covers the subject related to registration of employer/company and its employee under Social Security Fund.

1. Who should be registered under Social Security Fund?

The notice published on Nepal Gazette does not specify the fixed sectors, industries, businesses, and services that need to be enrolled with social security fund. Therefore, all employers and employee must be registered under Social Security Fund (SSF).

2. What is the authority to register Social Security Fund?

The registration should be done at the Office of Social Security Fund. The Office of Social Security Fund monitors, regulates and provides the certificate of social security. The Office of the Social Security Fund is located at Babarmahal, Kathmandu. The official website of the Social Security Fund is https://ssf.gov.np/np.

3. What is the procedure of enlisting the employee and employer in the Social Security Fund?

- Firstly, the employer most register its name under social security fund. The employer most submit the online form in prescribed format.

- The employer will get the certificate within 2 days from the date of application.

- After the registration of employer in social security, Employer should also register its existing employees.

( Please note, the employee should make registration of employee within 3 months from the date of appointment or establishment of employee relationship )

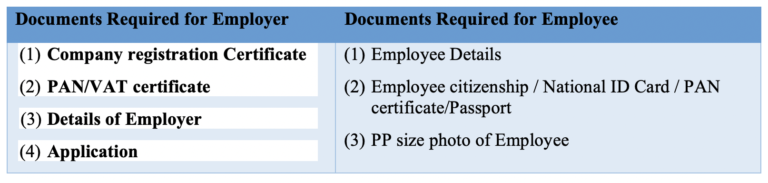

4. What are the documents required for registration of employer and employee under Social Security Fund?

The documents required for registration on Social Security Fund are as follows:

(Please Note: There is no need of physical submission of documents for Social Security Fund registration. Submission of documents online is sufficient.)

5. When was the last date given by Office of Social Security Fund for the registration ?

The last date of the registration was October 17, 2019 A.D (Ashoj 30, 2076 B.S.). Interested entity can register even in after the expiry of the time limit. Newly incorporated company should register once they start the company operation.

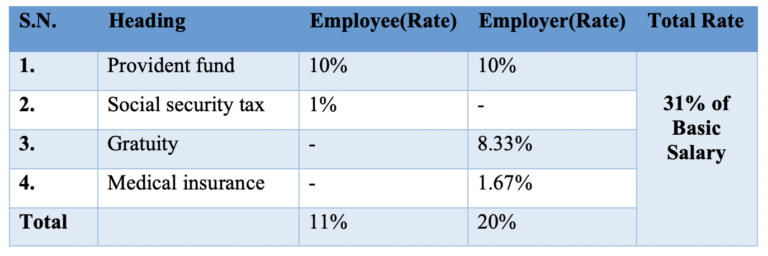

6. What is the rate of amount to be deposited in fund?

After Listing under the SSF, the Employees and Employers shall have to deposit an amount on following rate respectively:

The employee shall deposit 11 % and the employer shall add 20% of the basic salary per month (31% of the basic salary of employee) to the Fund every month.

7. Is there any government fee required for registration?

No government fee is required to list the Company or the Employees under SSF.

Disclaimer: This questionnaire is for informational purposes only and shall not be construed as legal advice, advertisement, personal communication, solicitation or inducement of any sort from the firm or any of its members. The firm shall not be liable for any consequence arising out of actions undertaken by any person relying on the information provided herein.

Related Professionals

aaa