Registration of a profit not distributing company in Nepal

7 Feb 2020

This questionnaire mainly covers legal provisions related to the registration process of a “Company not distributing profit” in Nepal.

1) What is a company not distributing profits?

A not for profit company is a company incorporated on conditions that it shall not be entitled to distribute or pay to its members any dividends or any other moneys out of the profits earned or savings made for the attainment of any objectives.

These companies are generally incorporated with the following objectives:

- Development and promotion of any profession;

- Protection of collective rights and interests of the persons engaged in a specific profession or occupation; or

- For the attainment of any scientific, academic, social, benevolent or public utility or welfare objective on the condition of not distributing dividends.

2) What is the governing law for a company not distributing profits?

Companies Act 2006 governs the registration and establishment of a company not distributing profits in Nepal.

3) What is the registration process for a company not distributing profits?

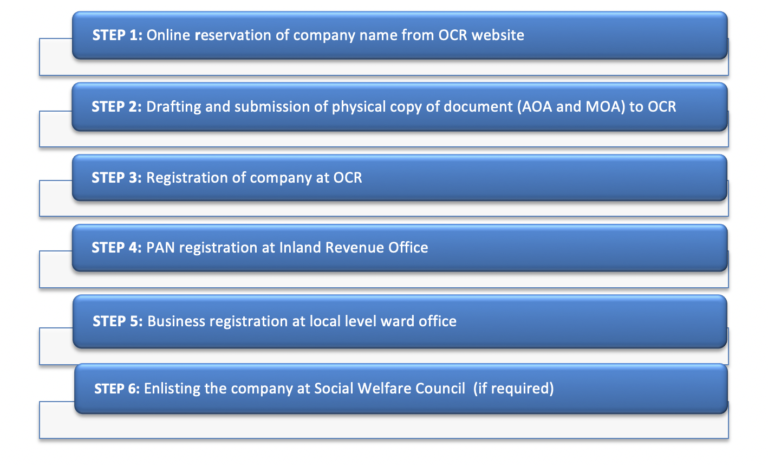

The basic steps for registration of a company not distributing profits is set out below.

4) How many members/promoters are required for registration?

A profit not distributing company requires at least five (5) promoters for registration. The Companies Act 2006 does not limit the maximum numbers of promoters. Any person, trustee of a public trust or corporate body can incorporate a company not distributing profits.

The membership is not transferable and expires only as a result of death, cancellation of registration or dissolution, voluntary resignation, and merger with another company.

5) What are the documents required for registration?

Following documents need to be submitted at the OCR for registration:

- Application for registration;

- Memorandum of Association (“MOA”) and Articles of Association (“AOA”) of proposed company (2 copies of each);

- Citizenship certificate of promoters and witnesses;

- Copy of certificate of registration, MOA, AOA and board resolution of the promoter, if promoter is a company; and

- Power of attorney for the registration.

6) What are the government fees applicable for registration?

Registration fees of NPR 15,000 is applicable for registration.

7) What is the timeline for registration?

It takes around 10 to 15 days for the completion of registration process.

8) What is the share capital requirement and liabilities of the members?

Share capital is not required for establishing a company not distributing profits and such company is not permitted to distribute dividend to its members.

The company may receive membership fees from its members and can receive donation, gift pursuant to law for the accomplishment of its objectives.

The liability of the members of such company is limited to the extent of the limit s/he has accepted in writing. The members are not liable to the debts and liabilities of the company.

9) Is it compulsory to enlist a company not distributing profits at the Social Welfare Council?

Enlistment at the Social Welfare Council is not compulsory. Enlistment is only required if the company is receiving grant from foreign countries or entities.

10) Are any tax exemptions available?

A profit not distributing company is entitled to tax exemption on income tax for operational income if it obtains certificate of a “tax exempted entity” pursuant to Income Tax Act 2002.

11) What is the compliance requirement for a company not distributing profits?

All corporate compliances under the Companies Act 2006, except those relating to share capital, which are applicable to a public company, are also applicable to a company not distributing profits.

A company not distributing profits is subject to account, audit and compliance requirements like other types companies.

Disclaimer: This questionnaire is for informational purposes only and shall not be construed as legal advice, advertisement, personal communication, solicitation or inducement of any sort from the firm or any of its members. The firm shall not be liable for consequences arising out of any action undertaken by any person relying on the information provided herein.

Related Professionals

aaa