Labour law in Nepal: Highlights of the Labour Act, 2017

10 June 2021

1. Introduction

The Labour Act, 2017 (“Labour Act“) came into effect on 04 September 2017 (2074-05-19) replacing the Labour Act, 1992 (“Previous Act“), Industrial Trainee Training Act, 2039 and Retirement Fund Act, 2049. The major provisions of the Labour Act are briefly set out below:

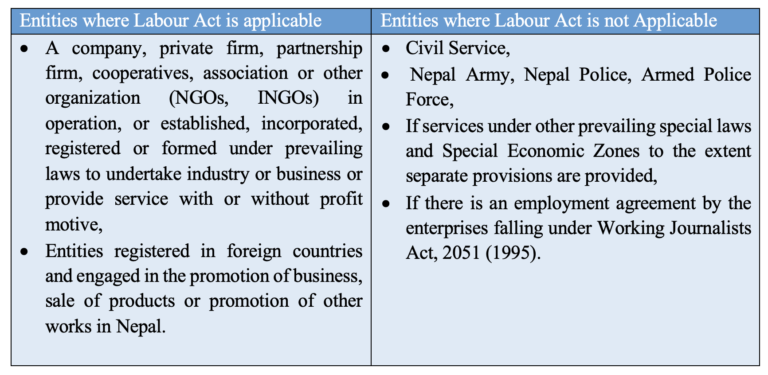

Applicability of the Labour Act

Note: The Labour Act is applicable to all entities regardless of headcounts. The Previous Act was only applicable to entities where 10 or more employees were engaged.

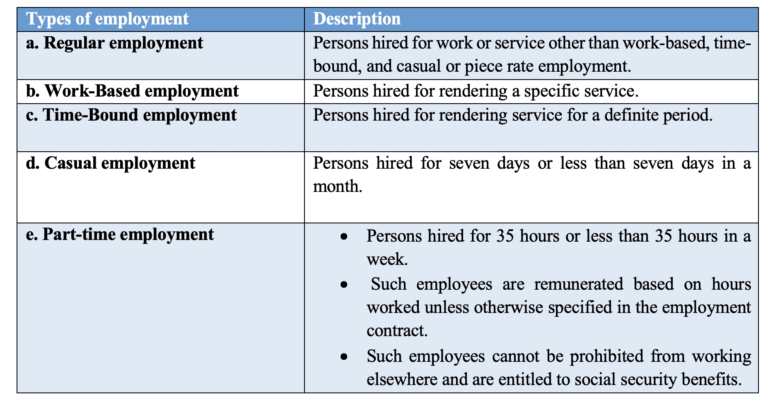

2. Types of employment

The Labour Act has categorized different types of employment as explained in the below table:

3. Term of probation

The Labour Act provides for a maximum of 6 (six) months of probation period to evaluate the work of an employee. If the work is not found satisfactory, the term of such employee can be terminated. The employment contract with the employee under probation, if not terminated, shall be deemed automatically valid after the end of provided probation period.

4. Provision related to intern and trainee

4.1 Intern

a) Any person may be allowed to work as an intern pursuant to the approved syllabus of an educational institution and after agreeing with that educational institution.

b) The interns should not be engaged at work exceeding 8 (eight) hours a day and 48 (forty-eight) hours a week.

c) They are entitled to health and safety arrangements, medical expenses and compensation in case of an injury at work and deemed as a regular employee if engaged in work other than prescribed in the agreement between educational institution and entity.

4.2 Trainee

a) A trainee employee may be appointed for a period of training not exceeding 1 (one) year unless otherwise prescribed by law.

b) All trainees shall be entitled to social security benefits including provident fund, gratuity and minimum remuneration.

c) The employer is not obliged to appoint the trainee as a regular employee upon the completion of the training period. However, if such trainee is appointed for work, probation period will not be applicable.

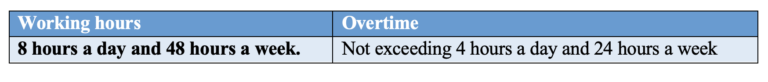

5. Working hours

Note: 30 minutes’ break must be provided after 5 (five) hours of work where such break is also considered as working hour.

6. Remuneration

6.1 Minimum remuneration/wage: The minimum remuneration was revised by the Ministry of Labour, Employment and Social Security on 03 May of 2021. The new minimum remuneration applicable from 16 July 2021 is NPR 15,000 per month. Overtime remuneration must be 1.5 times the regular remuneration.

6.2 Increment of the remuneration: Annual increment is applicable to an employee who has worked for at least 1(one) year and must be at the rate of half-day salary of the monthly basic remuneration.

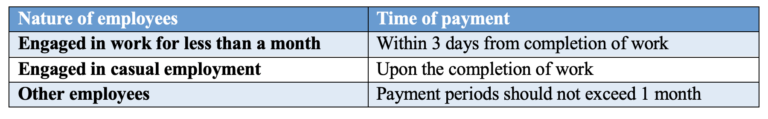

6.3 Payment of the remuneration:

The payment of the remuneration must be done on the following basis:

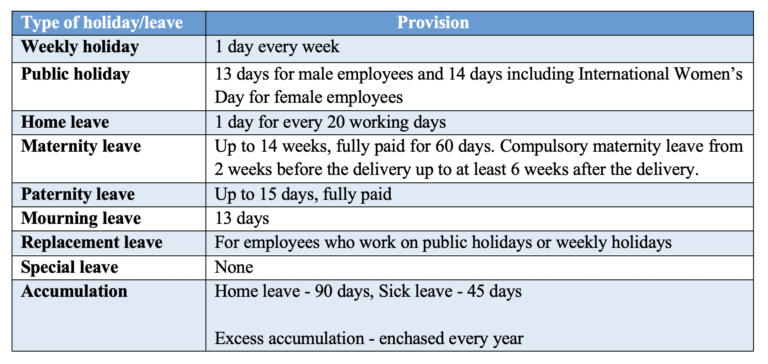

7. Holidays and leave

The Labour Act has provided for the following holidays and leave:

8. Social Security Fund

The provisions relating to the establishment of the Social Security Fund was first introduced in the Labour Act. Subsequently, Social Security Act, 2017 and Social Security Regulations, 2018 were enacted for the establishment and operation of a Social Security Fund. Further, Social Security Scheme Operational Directives, 2018 was enacted for the implementation and management of various social security schemes. The Previous Labour Act required employers to contribute 18.33% (comprising of 10% provident fund and 8.33% gratuity) additional amount from the basic salary of the employee. The Social Security Act and Social Security Regulations now require contribution of additional amount equal to 20% of the basic salary of the employee.

The major provisions of the Social Security Act, Social Security Regulations and Social Security Scheme Operational Directives are as follows:

- Mandatory enrollment requirement of employers and employees in the Social Security Fund.

- Total rate of contribution in the Social Security Fund set as 31% with 11% contribution to be deducted from the basic salary of the employee and 20% additional contribution by the employer.

- Introduction of social security schemes including medical treatment, health and maternity protection scheme, accident and disability protection scheme, dependent family protection scheme and old age protection scheme for the employees.

9. Disciplinary action to employee

Based on the nature of misconduct done by the employee, following disciplinary action can be taken:

- Warning;

- Deduction of one day’s remuneration;

- Withholding of Annual Salary Increment for one year or Withholding Promotion for one year;

- Withholding of Annual Salary Increment for one year or Withholding Promotion for one year;

- Termination upon misconduct; or

- Employment termination based on the seriousness of the offence.

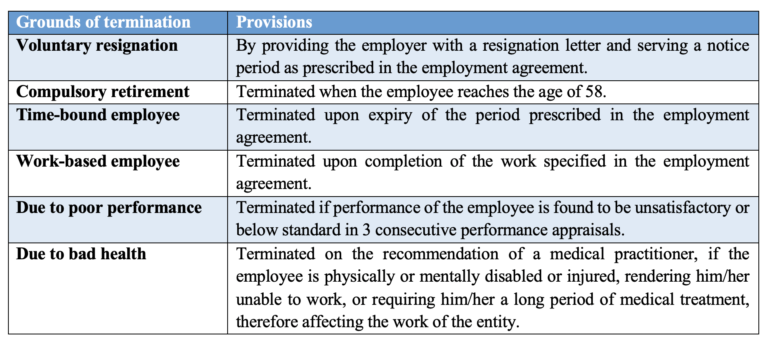

10. Employment termination

10.1 Grounds of employment termination

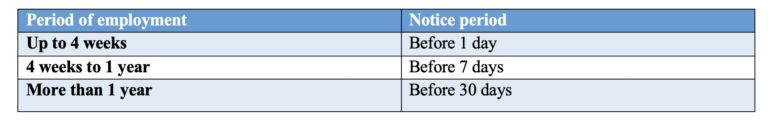

10.2 Requirement of the notice before termination

11. Retrenchment

The provisions of retrenchment provided by the Labour Act are not applicable to entities with less than 10 (ten) employees.

11.1 Conditions for retrenchment

Employees can be retrenched in any of the following circumstances:

- If due to the harsh economic conditions, there is a problem in the operation of the industry as usual;

- If there is an increment in the number of employees as a result of the merger; or

- If, due to any other situations/circumstances, the enterprise has to be a closed party or wholly.

11.2 Process of retrenchment

The employer should provide the details of retrenchment prior to 30 (thirty) days by specifying the reasons for retrenchment, possible date of retrenchment and number of employees to be provided to the Labour Office and authorized trade union or labour relation committee (if any).

11.3 Compensation for retrenchment

The employees are entitled to retrenchment compensation at the rate of 1 (one) month salary for each year of service. Likewise, compensation must be paid on a proportionate basis for service rendered below 1 (one) year.

12. Collective Bargaining

12.1 Formation of collective bargaining committee

The Labour Act provides that an entity can form a collective bargaining committee if there are 10 (ten) or more than 10 (ten) employees. The committee should be formed by an authorized trade union or by all trade unions in absence of an authorized trade union or by the signature of 60 (sixty) per cent workers in absence of any trade union.

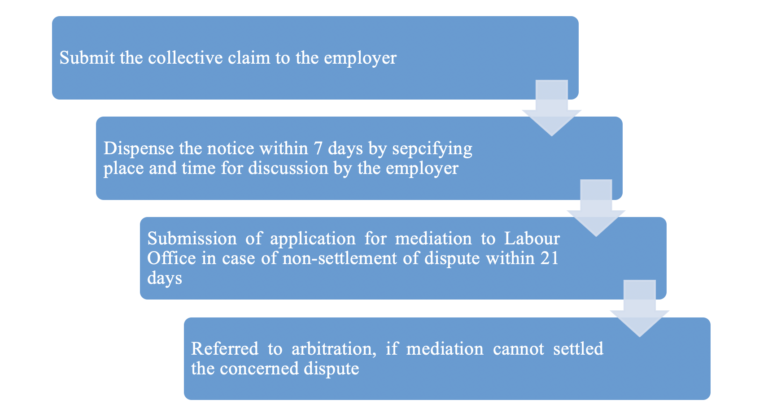

12.2 Procedure for settlement of collective dispute

12.3 Collective bargaining agreement

The following arrangements can be done through collective bargaining:

- To reduce the remuneration of the employee;

- Arrangement for Interim Management during the transfer of ownership;

- To agree on certain facilities in lieu of overtime payment;

- To determine facilities for which the employer may deduct the remuneration;

- To determine the grounds of transfer of employees;

- Determination of rate of remuneration during the period of legal strike or lockout;

- To add the grounds of termination upon misconduct; and

- To determine the alternative option of retrenchment, and criteria and terms of retrenchment.

13. Labour Court

13.1 Establishment of Labour Court

The Government of Nepal can establish required number of labour courts by publishing the notification in the Nepal Gazette. The Labour Court consists of one Chairperson and two members to decide the case relating to labour disputes.

13.2 Jurisdiction of Labour Court

The Labour Court may use the following powers in the course of deciding a case:

- Witness examination;

- Seek necessary explanation from respondent treating it as a written statement;

- The Labour Court, based on application or nature of the case, suo moto may give an order to summon any party during the hearing even though such party has been made neither defendant nor respondent in the case and if necessary make him a party to the case;

- Inspect places of work relating to the dispute;

- If an application filed by any party to the case to keep a case sub judice in the Labour Court in pending or give continuity till it is finally decided and disposed is found reasonable, notwithstanding the state of the case, the Labour Court may issue an interlocutory order against any of the parties to stop any act for a specified time or give continuity to any activity with or without fixing a period;

- Confirm or invalidate or alter any directive or decision or order given by the Labour Office or an employer;

- The Labour Court, when carrying out the court proceeding and disposing of the case, shall be the powers as prescribed over the matters specified in the Labour Act or the Regulations made thereunder and in other matters, it shall have the powers equivalent to that of any other District Court.

13.3 Enforcement of decision

The case must be resolved within 90 (ninety) days of filing the application in the Labour Court. The Government of Nepal is responsible for enforcing the decision provided by the Labour Court.

13.4 Appeals in the Supreme Court

The dissatisfied party regarding the decision of the Labour Court in a case looked into by the court from the beginning to the end may appeal in the Supreme Court within 35 (thirty-five) days from the date of announcement of such decision.

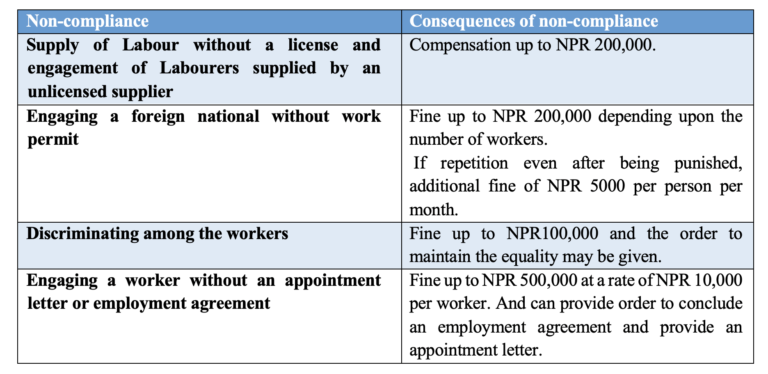

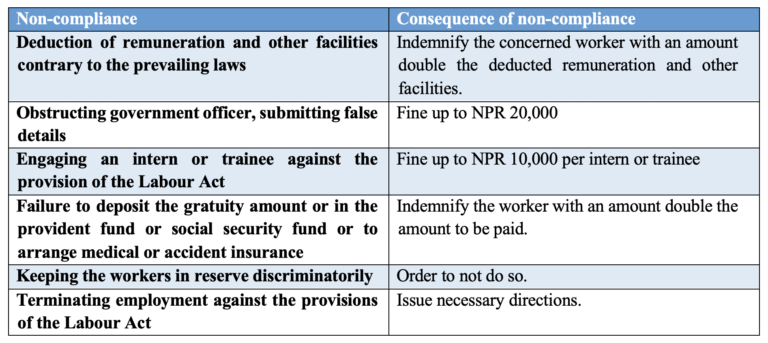

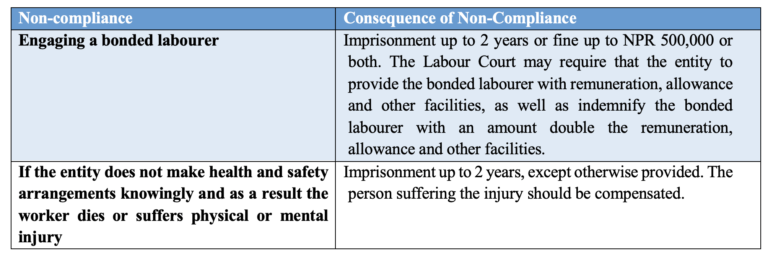

14. Sanctions for non-compliance

A brief outline of the sanctions provided in the Labour Act are as follows:

14.1 Labour Department can impose the following sanctions to the Employer on the following nature of non-compliance:

14.2 Labour Office can impose the following sanctions to the employer on the following nature of non-compliance:

14.3 Labour Court can impose the following sanctions to the Employer on following nature of non-compliance:

Disclaimer: This article is for informational purposes only and shall not be construed as legal advice, advertisement, personal communication, solicitation or inducement of any sort from the firm or its members. The firm shall not be liable for consequences arising out of actions undertaken by any person relying on the information provided herein.